Holiday Times In Your Office

So the holidays are just around the corner. The office is decorated and gift packages are making the rounds throughout the office. Each day we find new treats in the kitchen or on the receptionist’s desk, and everyone seems to be relaxing. Hey…business is off by 50%. Right?

Hey it's the holidays, and business is down. Well, although I hear that logic from many brokers we deal with, it should not be the case. We need to be careful not to use the holidays as an excuse for month-end volumes. Instead, we should be taking advantage of this precious time.

Let's face it. Throughout the year, we're lucky we have enough time to finish our coffee before it gets cold — let alone worry about tasks that don’t specifically generate closed loans. But now is really your time to set the groundwork for 2007.

Dust off your old leads, and get some phone time in with your newer loan officers. Schedule training within your office. Look at your internal systems and what problems you have experienced over the past year, and determine what needs improvement. Get your IT dept to take a peek into your database, and do some housekeeping. Consider a holiday e-mail to your house file. Contact your vendors , and take some time to review both the good and bad that you experienced throughout the year. Look through your schedules or planners of clients you wanted to meet, but did not have the luxury to schedule time with them.

Although the holidays do slow down your business, it should not prevent you from reallocating your efforts to insure that 2007 starts off solid. I wish you and your families the very best this holiday season!

Submitted by Greg Kazmierczak

Get the facts about Internet Mortgage Leads and Lead Generation Companies before you write that check! This Forum serves the interest of all who purchase internet leads. Mortgage Lead Forum is an outlet that enables intelligent business decisions based on others' experiences. Mortgage leads, refinancing leads, internet leads, debt consolidation leads.

Friday, December 08, 2006

Saturday, November 18, 2006

WebMktgSolutions.com released its first ever focus group which explores what mortgage companies and brokers feel about the mortgage lead generation industry. Below are some of the highlights of the findings. Why do you use lead companies? The vast majority, eighty three percent of us use internet leads to supplement our existing lead flow followed by the fact that smaller brokers do not have the experienced marketing staff to generate a cost effective internet lead

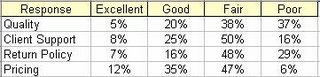

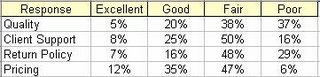

Overall satisfaction with your lead provider. This was broken down into 4 main categories

Price was the least sensitive variable. Most of us are willing to pay an additional cost for a lead that we know is a valid lead. Some indicated they would be willing to spend as much as $10.00 more per lead. Of those respondents who provided us with narrative feedback, the #1 issue addressed was the return policy. At times return policies were not up-held or worse the solution was simply replacement leads of the same poor quality

Over the past several months WebMktgSolutions.com has taken a very pro-active approach in identifying what the internet lead industry needs to do to earn your business. We have spoken and corresponded with brokers, mortgage companies and our own clients throughout the U.S. They have shared with us their frustrations, success stories and overall thoughts on improving the relationship between the lead buyer and seller. Our focus here is to assist you in making sound decisions on what companies to use and how to develop that relationship along the way

There are several blogs out there that provide great feedback on lead companies so you don’t make the same mistakes. A few are http://www.mortgagefraudblog.com/ http://www.mortgageleadsguide.com/Mortgage_Leads_Reviews.asp. For the complete results of the Mortgage Lead Report click on 2006 Mortgage Lead Industry Review

Submitted by Greg Kazmierczak

Overall satisfaction with your lead provider. This was broken down into 4 main categories

Price was the least sensitive variable. Most of us are willing to pay an additional cost for a lead that we know is a valid lead. Some indicated they would be willing to spend as much as $10.00 more per lead. Of those respondents who provided us with narrative feedback, the #1 issue addressed was the return policy. At times return policies were not up-held or worse the solution was simply replacement leads of the same poor quality

Over the past several months WebMktgSolutions.com has taken a very pro-active approach in identifying what the internet lead industry needs to do to earn your business. We have spoken and corresponded with brokers, mortgage companies and our own clients throughout the U.S. They have shared with us their frustrations, success stories and overall thoughts on improving the relationship between the lead buyer and seller. Our focus here is to assist you in making sound decisions on what companies to use and how to develop that relationship along the way

There are several blogs out there that provide great feedback on lead companies so you don’t make the same mistakes. A few are http://www.mortgagefraudblog.com/ http://www.mortgageleadsguide.com/Mortgage_Leads_Reviews.asp. For the complete results of the Mortgage Lead Report click on 2006 Mortgage Lead Industry Review

Submitted by Greg Kazmierczak

Sunday, January 01, 2006

Learning to get the most use out of your Internet mortgage leads can take some time, particularity if you have newer loan officers. Your loan officer is your first line of defense on lead quality. Your star Loan Officer’s opinion counts. Your best non-biased feedback will come from your top producers in your office. In many cases they are the most experienced and will give invaluable input on the lead quality. It was surprising for me to discover just how many brokers gave new Internet lead sources to their new loan officers, some who have never worked Internet leads before. We all are concerned with loan officer retention but in order for us to draw a fair conclusion on a new lead source we need to filter them through the loan officers in our office with the most experience in Internet leads. This brings me to the next subject.

Loan Officer History

How many of us at then end of the week or month know how many leads we gave our loan officers and more importantly what lead source it came from? Chances are if you are a large mortgage company your system generates these reports but if you are a smaller company you probably have to rely on verbal feedback. I have heard many situations of companies going through leads month after month without knowing anything about the lead, other than it was bad. Don’t rely on loan officers to give you all the feedback you are looking for. Tracking your lead quality and costs goes hand-in-hand with loan officer productivity on the lead source.

Let’s walk through the below example for June:

You spend a total of $10,875.00 on your leads. You just signed on Acme Lead Co. as a new lead source who sent you 95 leads for June. All your loan officers received leads from that source but one loan officer in particular received 75% of the leads from Acme. Would your company be able to identify that particular loan officer if you had this scenario? If you are able to identify the loan officer you can greatly decrease your lead costs and also identify your weaker loan officers. Let’s assume Terry received 75% of the leads from Acme. Now you are in a position to go to Terry and begin your discovery process. Also it allows you to look at Terry’s overall performance against his other lead sources to determine if, in fact it’s the lead source. Perhaps Terry is a newer loan officer. Reference Terry’s pervious months against June to determine any inconstancies.

Within your company you should be able to determine not only which loan officers are closing leads and from what source but also which loan officers are spending most of your lead budget. Determining your cost per funded loan per loan officer is just as important as determining your overall lead cost per loan officer. Now you are in a much better position to make an educated decision about the quality of a lead source

Loan Officer History

How many of us at then end of the week or month know how many leads we gave our loan officers and more importantly what lead source it came from? Chances are if you are a large mortgage company your system generates these reports but if you are a smaller company you probably have to rely on verbal feedback. I have heard many situations of companies going through leads month after month without knowing anything about the lead, other than it was bad. Don’t rely on loan officers to give you all the feedback you are looking for. Tracking your lead quality and costs goes hand-in-hand with loan officer productivity on the lead source.

Let’s walk through the below example for June:

You spend a total of $10,875.00 on your leads. You just signed on Acme Lead Co. as a new lead source who sent you 95 leads for June. All your loan officers received leads from that source but one loan officer in particular received 75% of the leads from Acme. Would your company be able to identify that particular loan officer if you had this scenario? If you are able to identify the loan officer you can greatly decrease your lead costs and also identify your weaker loan officers. Let’s assume Terry received 75% of the leads from Acme. Now you are in a position to go to Terry and begin your discovery process. Also it allows you to look at Terry’s overall performance against his other lead sources to determine if, in fact it’s the lead source. Perhaps Terry is a newer loan officer. Reference Terry’s pervious months against June to determine any inconstancies.

Within your company you should be able to determine not only which loan officers are closing leads and from what source but also which loan officers are spending most of your lead budget. Determining your cost per funded loan per loan officer is just as important as determining your overall lead cost per loan officer. Now you are in a much better position to make an educated decision about the quality of a lead source

Subscribe to:

Posts (Atom)