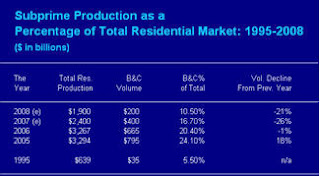

October was definitely a month for brokers to vent to me. Some have stopped using Internet leads all together. Their stories all seem to have one common element. Customers have been hounded to the point they no longer want to speak to a broker. This leads me to my frustration and our overall expectations with respect to Internet leads. Are brokers expecting too much with the ever shrinking origination volumes? The chart below shows the story. The later part of 2006 and all of 2007 have seen origination volumes significantly decrease.

So what does this mean for Internet lead companies; less available inventory. It's that simple. We cannot expect the lead company to have the same volume of leads they did last year or the last six months for that matter. I think we have to take a hard look at a lead company and its operations and come to grips with some realities. Each day the lead company spends thousands on advertising to generate their leads. There obviously needs to be an effective return on these advertising dollars. So here is the million dollar question. If their lead prices are not increasing and they are still able to provide the same volume of leads and can guarantee that the consumer will only receive 3-4 telephone calls, you need to ask them how this is possible. It is getting extremely difficult to cost effectively generate mortgage leads online. If a lead company is telling you their lead prices are going up that is the reason and we have to accept the reality if we want to continue to purchase Internet leads. Each lead company is going after the same customer and there are incremental costs to capture that ever shrinking customer base. The lead buyer needs to bare that cost otherwise more and more lead companies will be getting out of the business.