Get the facts about Internet Mortgage Leads and Lead Generation Companies before you write that check! This Forum serves the interest of all who purchase internet leads. Mortgage Lead Forum is an outlet that enables intelligent business decisions based on others' experiences. Mortgage leads, refinancing leads, internet leads, debt consolidation leads.

Tuesday, October 23, 2007

Monday, October 01, 2007

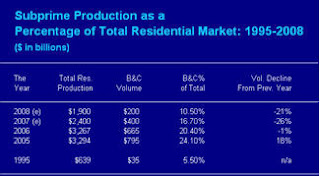

October was definitely a month for brokers to vent to me. Some have stopped using Internet leads all together. Their stories all seem to have one common element. Customers have been hounded to the point they no longer want to speak to a broker. This leads me to my frustration and our overall expectations with respect to Internet leads. Are brokers expecting too much with the ever shrinking origination volumes? The chart below shows the story. The later part of 2006 and all of 2007 have seen origination volumes significantly decrease.

So what does this mean for Internet lead companies; less available inventory. It's that simple. We cannot expect the lead company to have the same volume of leads they did last year or the last six months for that matter. I think we have to take a hard look at a lead company and its operations and come to grips with some realities. Each day the lead company spends thousands on advertising to generate their leads. There obviously needs to be an effective return on these advertising dollars. So here is the million dollar question. If their lead prices are not increasing and they are still able to provide the same volume of leads and can guarantee that the consumer will only receive 3-4 telephone calls, you need to ask them how this is possible. It is getting extremely difficult to cost effectively generate mortgage leads online. If a lead company is telling you their lead prices are going up that is the reason and we have to accept the reality if we want to continue to purchase Internet leads. Each lead company is going after the same customer and there are incremental costs to capture that ever shrinking customer base. The lead buyer needs to bare that cost otherwise more and more lead companies will be getting out of the business.

Thursday, August 16, 2007

Have you received e-mails regarding "Free Leads" lately? Like the saying goes.... If it looks too good to be true! One cannot go one day without reading about yet another mortgage company or broker getting out of the business. With so many of the larger players either filing for bankruptcy or significantly changing their lending criteria we are seeing applications of the non-prime customer not being accepted.

For the lead companies what this means is the inability to resell the leads they generated and paid marketing dollars for. Most genuine lead companies generate their online leads through the following sources:

1. SEO or search engine optimization of their site

2. Working with affiliate partners, other websites that will place their banners or send out e-mails in exchange for remuneration if someone clicks on the ad or completes the lead form

3. Pay per click advertising

Many lead companies are unable to filter their marketing dollars to attract prime credit internet customers. What this means is each day leads are going unsold. As the industry further realigns itself the cost of mortgage leads to the lead companies will further increase. So how can a company afford to give away leads for FREE? The answer is they can't. It is a common ploy to get you to try them out, some in fact will send you good “free” leads and THEN once you sign a contract they will be happy to flood you with bad lead as part of the mix. At that point you’re on the hook for the full contract amount.

We encourage you to read some of the articles on this Blog to learn more about lead generation and what a true lead generation company does how they generate leads and how they make money. Knowing this will give you a greater appreciation of why mortgage leads are going up in price and not the opposite.

For the lead companies what this means is the inability to resell the leads they generated and paid marketing dollars for. Most genuine lead companies generate their online leads through the following sources:

1. SEO or search engine optimization of their site

2. Working with affiliate partners, other websites that will place their banners or send out e-mails in exchange for remuneration if someone clicks on the ad or completes the lead form

3. Pay per click advertising

Many lead companies are unable to filter their marketing dollars to attract prime credit internet customers. What this means is each day leads are going unsold. As the industry further realigns itself the cost of mortgage leads to the lead companies will further increase. So how can a company afford to give away leads for FREE? The answer is they can't. It is a common ploy to get you to try them out, some in fact will send you good “free” leads and THEN once you sign a contract they will be happy to flood you with bad lead as part of the mix. At that point you’re on the hook for the full contract amount.

We encourage you to read some of the articles on this Blog to learn more about lead generation and what a true lead generation company does how they generate leads and how they make money. Knowing this will give you a greater appreciation of why mortgage leads are going up in price and not the opposite.

Thursday, August 02, 2007

Ok we’re well into the summer and in about 6 weeks the kids are back from camp and ready for another year of school and the parents will settle back into their routines. What are we doing to prepare. It is really difficult tying folks down over the summer. It seems there is always something distracting us. One company I spoke to sends out cards with vacation themes to its prospects simply stating, " I hope you are enjoying your summer and look forward to reviewing your information you sent us. I will give you a call the week of (-----) so we can start working on a financial solution that best meets your needs.

Another company has had success with a vacation photo contest. Potential customer are asked to e-mail their funniest vacation photo and winners are announced on the company website.

The point I am making is that the summer should not be a time to find excuses. One loan officer as she stated, "Hey if my phone is not ringing and nobody is returning my calls, I will go to them". She is sponsoring a table at her pools swim meets. What a ridiculous idea right? Wrong, the table costs $125.00 for each meet 4 weeks into it and she had three deals and the real kicker is that she went through 1000 business cards

Another company has had success with a vacation photo contest. Potential customer are asked to e-mail their funniest vacation photo and winners are announced on the company website.

The point I am making is that the summer should not be a time to find excuses. One loan officer as she stated, "Hey if my phone is not ringing and nobody is returning my calls, I will go to them". She is sponsoring a table at her pools swim meets. What a ridiculous idea right? Wrong, the table costs $125.00 for each meet 4 weeks into it and she had three deals and the real kicker is that she went through 1000 business cards

Tuesday, June 19, 2007

Did you ever wonder what happened to the days when a loan officer walked into the office and there were 10 Internet leads waiting for him/her to call? Well those days are gone. I have spoken to several brokers over the past 60 days who tell me of a re-occurring problem they are having with their younger loan officers; they have made a good chunk of change over the past 5 years and are now resting on their laurels. Depending on their compensation program that may be ok since they are only getting paid for funded deals. On the other hand it sends a bad message to the other loan officers who are coming in the office and hitting the phones. There are hidden jewels in old internet leads. One company I know in particular requires their loan officers to make 50 calls a day to old internet leads and closing them. Face it, you paid for them and we all know that consumer circumstances change from month to month. Loan officers should be using every available resource to drum up new business. This included hitting the phones. The industry has gotten lazy to a certain point and it will be the loan officers that change their mentality who will intimately survive.

Wednesday, May 30, 2007

Many people have asked me how much technology is involved in getting an in-house lead gen program started. The answer depends on how involved you want it to be. You can take advantage of the technologies currently available with some of the larger networks such as Commission Junction, clixGalore and affiliateprograms.com. The tracking is hosted by them so you need to simply apply the tracking code information they give you to your "success page". This will give you a foundation as you built out your own lead gen program. Start small and get your learning. Once you have tested offers and different banners and you know what is working you are ready to look at a long-term strategy that might involve hiring a developer or consultant to custom tailor your platform based on your business or your needs.

Wednesday, May 16, 2007

So we have relied on lead companies for several years and now we are finding some of them are not providing the volume we need. For the smaller brokers out there this poses a dilemma. We find ourselves short of lead inventory. We have little to no marketing experience and know next to nothing about internet lead generation. So what is next? There are some ways we can begin to educate ourselves without spending wasted monies. Google and Overture for the smaller broker can be costly depending on the keywords mix we manage. http://www.superpages.com./on the other hand is an easy way to start familiarizing yourself with internet marketing and generating mortgage leads. The same holds true for the yellow pages on line. They are geographically targeted and tend to be less expensive than the bidding on Google and Overture. Start contacting some of your local websites and inquire about banner ad pricing. You may be surprised how relatively inexpensive it is. Local newspapers, TV and radio stations are great starting points.

Over the next few weeks I will be adding several methods that will assist you in starting up your own small internal mortgage lead generation program.

Over the next few weeks I will be adding several methods that will assist you in starting up your own small internal mortgage lead generation program.

Wednesday, May 09, 2007

As our industry is going through some significant changes and readjustments we need pay particular attention to our lead vendors or the number of vendors we are working with if we are to maintain a profitable platform.

Many of us are discovering our vendors are running out of inventory. As we call lead companies and ask for 25 or 50 per day; many will say sure not a problem but what we are hearing is that many can not deliver. The reason, most mortgage companies and brokers are looking for lower LTV's and higher loan amounts. Program criteria is being is becoming conservative and it is getting more and more challenging to provide the type of lead the industry is looking for and still be cost-effective at the end of the day. For the lead company this means much higher lead acquisition costs as incremental advertising dollars are spent trying to get the pool of leads to satisfy the new appetites of the lead buyers. Don’t be surprised if lead prices go up or lead companies try new advertising methods to capture the audience lead buyers are now searching for.

Many of us are discovering our vendors are running out of inventory. As we call lead companies and ask for 25 or 50 per day; many will say sure not a problem but what we are hearing is that many can not deliver. The reason, most mortgage companies and brokers are looking for lower LTV's and higher loan amounts. Program criteria is being is becoming conservative and it is getting more and more challenging to provide the type of lead the industry is looking for and still be cost-effective at the end of the day. For the lead company this means much higher lead acquisition costs as incremental advertising dollars are spent trying to get the pool of leads to satisfy the new appetites of the lead buyers. Don’t be surprised if lead prices go up or lead companies try new advertising methods to capture the audience lead buyers are now searching for.

Friday, March 30, 2007

By: Jay Conners

When it comes to buying mortgage leads, there are many good companies out there for you to research, and many avenues to travel down when considering which lead type will work best for you.

When it comes to buying mortgage leads, there are many good companies out there for you to research, and many avenues to travel down when considering which lead type will work best for you. While working as a loan officer, I dealt with my fair share of mortgage lead companies. Along the way, I bought my leads in bulk, I bought them fresh, and I bought them with a live transfer.

Researching lead companies is an important aspect when deciding to invest in one, but lets be honest with each other, we really don’t know what we are getting until we begin to purchase them. When I would purchase my leads in bulk, I would take $100.00 of my hard earned money, find what I believed to be the best cherry-picking site out there, and by about fifty leads at $2.00 each. Now I know that you get what you pay for, and my goal was to close two at the most, and at the very least, one. Over the years this approach would occasionally pay off, but I had the feeling of working harder, and not smarter.

The next approach I took a shot at was the purchase of "real time leads," or "fresh leads." I would take that same hard earned $100.00 and receive approximately three to five fresh leads consisting of purchase leads and refinance. These leads I did not cherry pick, I would set up a filter before hand. The filter would be specific to state, type of loan, credit, ltv, loan amount. Etc.

When a lead came in and matched my filter, it would be stream lined directly to my e-mail account, and it would be roughly ten minutes old. I had a lot of success with these leads, but continued to keep all of my options open.

The other type of lead I decided to take a shot at was the live transfer lead. I believed this to be a wonderful concept, and a very efficient way of obtaining leads and increasing my applications.

I basically sat at my desk and waited for the lead company to transfer customers to me by way of the telephone. Sometimes this worked and sometimes it didn’t. The problem was, there was no guarantee that I was going to answer the phone. I worked in an office with ten other loan officers, if I stepped away from my desk, they would end up in my voice mailbox, or if the phone went unanswered, the potential customer would hang up.

It is pointless to go into further detail, I think you get the picture, the live transfer at times could be a mess. Again, I felt as though I was working harder and not smarter. Before investing with mortgage lead companies, make sure you do your home work thoroughly. Read the companies "terms of service," find out what their return policy is, call and speak with a representative, ask about a free trial. Does it consist of a free lead or some type of credit toward your first deposit? If they are confident in the quality of their leads, than they should not have a problem accommodating you.

I have had, and know loan officers who have had success with all of the above mentioned lead type scenarios. Some may work for you and some may not. But remember, if you find yourself working too hard to make the lead work for you, consider a different type of lead!Jay Conners has more than fifteen years of experience in the banking and Mortgage Industry, He is the owner of http://www.jconners.com a mortgage resource site.

When it comes to buying mortgage leads, there are many good companies out there for you to research, and many avenues to travel down when considering which lead type will work best for you.

When it comes to buying mortgage leads, there are many good companies out there for you to research, and many avenues to travel down when considering which lead type will work best for you. While working as a loan officer, I dealt with my fair share of mortgage lead companies. Along the way, I bought my leads in bulk, I bought them fresh, and I bought them with a live transfer.

Researching lead companies is an important aspect when deciding to invest in one, but lets be honest with each other, we really don’t know what we are getting until we begin to purchase them. When I would purchase my leads in bulk, I would take $100.00 of my hard earned money, find what I believed to be the best cherry-picking site out there, and by about fifty leads at $2.00 each. Now I know that you get what you pay for, and my goal was to close two at the most, and at the very least, one. Over the years this approach would occasionally pay off, but I had the feeling of working harder, and not smarter.

The next approach I took a shot at was the purchase of "real time leads," or "fresh leads." I would take that same hard earned $100.00 and receive approximately three to five fresh leads consisting of purchase leads and refinance. These leads I did not cherry pick, I would set up a filter before hand. The filter would be specific to state, type of loan, credit, ltv, loan amount. Etc.

When a lead came in and matched my filter, it would be stream lined directly to my e-mail account, and it would be roughly ten minutes old. I had a lot of success with these leads, but continued to keep all of my options open.

The other type of lead I decided to take a shot at was the live transfer lead. I believed this to be a wonderful concept, and a very efficient way of obtaining leads and increasing my applications.

I basically sat at my desk and waited for the lead company to transfer customers to me by way of the telephone. Sometimes this worked and sometimes it didn’t. The problem was, there was no guarantee that I was going to answer the phone. I worked in an office with ten other loan officers, if I stepped away from my desk, they would end up in my voice mailbox, or if the phone went unanswered, the potential customer would hang up.

It is pointless to go into further detail, I think you get the picture, the live transfer at times could be a mess. Again, I felt as though I was working harder and not smarter. Before investing with mortgage lead companies, make sure you do your home work thoroughly. Read the companies "terms of service," find out what their return policy is, call and speak with a representative, ask about a free trial. Does it consist of a free lead or some type of credit toward your first deposit? If they are confident in the quality of their leads, than they should not have a problem accommodating you.

I have had, and know loan officers who have had success with all of the above mentioned lead type scenarios. Some may work for you and some may not. But remember, if you find yourself working too hard to make the lead work for you, consider a different type of lead!Jay Conners has more than fifteen years of experience in the banking and Mortgage Industry, He is the owner of http://www.jconners.com a mortgage resource site.

Friday, March 16, 2007

Sharon Hassler gives some great incite with her top 10 list of Steps to Finding the Best Mortgage Lead Companies. If you would like to read the entire article you can visit her site at http://www.blogaea.com/telemarketinglists/10-steps-to-finding-the-best-mortgage-leads-companies/

1. Does the mortgage leads company seem reputable?

2. Where do the leads come from?

3. How many times do they sell or recycle the same lead?

4. How about exclusive mortgage leads?

5. Can you cherry pick or filter your mortgage leads?

6. Is there a guarantee?

7. How much will each mortgage lead cost?

8. What exactly is your financial commitment?

9. Set aside a block of time to research companies.

10. Where do you find mortgage leads companies?

1. Does the mortgage leads company seem reputable?

2. Where do the leads come from?

3. How many times do they sell or recycle the same lead?

4. How about exclusive mortgage leads?

5. Can you cherry pick or filter your mortgage leads?

6. Is there a guarantee?

7. How much will each mortgage lead cost?

8. What exactly is your financial commitment?

9. Set aside a block of time to research companies.

10. Where do you find mortgage leads companies?

Wednesday, March 07, 2007

Saw a great article on Leadpoint Vs. Root Exchange on http://morinsight.com/about/ it goes into some nice detail as to the advantages and disadvantages of each platform. One of the main disadvantages people have told me is that some of us can get caught up in the bidding process. Those smaller brokers might be willing to hike up the price $50-$55 per lead but the larger brokers working on volume tend to bid around $35 therefore their lead volume might suffer. If anyone has direct experience with these companies we would be interested in your opinion

Thanks

Greg

Thanks

Greg

Tuesday, February 20, 2007

What Is A Bad Lead?

It seems like an easy question to answer, but many of us find it difficult to hold ourselves accountable to the definition. Let me explain. Over 80 percent of the companies we spoke with told us a bad lead is simply a bad phone number, a disconnected phone number or someone who said they did not apply. What we in fact discovered is that, at times, some of us who are newer to Internet lead purchasing are requesting credit for customers we cannot get in touch with or even some who want credit for leads that did not go to application.

If the lead company provides a lead from an interested party and the contact information is valid, then they did their job. After that the onus is on us and our trained loan officers to close the deal. There needs to be a healthy give-and-take in the relationship between the lead vendor and the mortgage company. Just like a dating relationship, we try to be on our best behavior, and somewhere along the line, our true colors are shown. Each of us needs to have a healthy appreciation of the other’s business; if we have that, we can put our best foot forward from the start and maintain a strong business partnership throughout.We all know things occur in our operations, e.g., new loan officers start, our programs change, new competition etc. Contrary to a few beliefs out there, not every lead you receive will fund. It is the lead provider’s responsibility to prevent you from getting “bad” leads and in fact credit those where the customer obviously was not interested. That said, it’s the mortgage company’s responsibility to not take advantage of the situation.

In my travels to industry tradeshows and seminars, I am still amazed by the type of questions I get from lead buyers: “Greg, do you know what companies ‘guarantee’ their leads?” or “Can your company ‘guarantee’ a funding rate of 5% or higher? Do you give credit for ‘ineligible’ customers?” When I ask them their definitions of “guarantee” or “ineligible,” I get a variety of answers. The simple truth is that their questions are a direct response to the frustration that has built up over the years from dealing with various lead companies in the industry. A healthy initial dialogue on the part of the lead buyer and seller is needed before marketing dollars are spent and contracts are signed. There are some very specific questions to ask the lead provider in determining the overall value and lead quality they bring to your company. Once you have those down your lead provider becomes and extension of your marketing department and not just a vendor.

Submitted by Greg Kazmierczak

It seems like an easy question to answer, but many of us find it difficult to hold ourselves accountable to the definition. Let me explain. Over 80 percent of the companies we spoke with told us a bad lead is simply a bad phone number, a disconnected phone number or someone who said they did not apply. What we in fact discovered is that, at times, some of us who are newer to Internet lead purchasing are requesting credit for customers we cannot get in touch with or even some who want credit for leads that did not go to application.

If the lead company provides a lead from an interested party and the contact information is valid, then they did their job. After that the onus is on us and our trained loan officers to close the deal. There needs to be a healthy give-and-take in the relationship between the lead vendor and the mortgage company. Just like a dating relationship, we try to be on our best behavior, and somewhere along the line, our true colors are shown. Each of us needs to have a healthy appreciation of the other’s business; if we have that, we can put our best foot forward from the start and maintain a strong business partnership throughout.We all know things occur in our operations, e.g., new loan officers start, our programs change, new competition etc. Contrary to a few beliefs out there, not every lead you receive will fund. It is the lead provider’s responsibility to prevent you from getting “bad” leads and in fact credit those where the customer obviously was not interested. That said, it’s the mortgage company’s responsibility to not take advantage of the situation.

In my travels to industry tradeshows and seminars, I am still amazed by the type of questions I get from lead buyers: “Greg, do you know what companies ‘guarantee’ their leads?” or “Can your company ‘guarantee’ a funding rate of 5% or higher? Do you give credit for ‘ineligible’ customers?” When I ask them their definitions of “guarantee” or “ineligible,” I get a variety of answers. The simple truth is that their questions are a direct response to the frustration that has built up over the years from dealing with various lead companies in the industry. A healthy initial dialogue on the part of the lead buyer and seller is needed before marketing dollars are spent and contracts are signed. There are some very specific questions to ask the lead provider in determining the overall value and lead quality they bring to your company. Once you have those down your lead provider becomes and extension of your marketing department and not just a vendor.

Submitted by Greg Kazmierczak

Subscribe to:

Posts (Atom)